GAP COVERAGE

TOTAL LOSS & THEFT PROGRAM

GUARANTEED ASSET PROTECTION

Your credit union has joined forces with IWS to offer you GUARANTEED ASSET PROTECTION (GAP). Through partnerships with insurance carriers who are rated A or better, by leading insurance analyst A.M. Best Co., Inc., IWS brings peace of mind and financial security to credit union members nationwide.

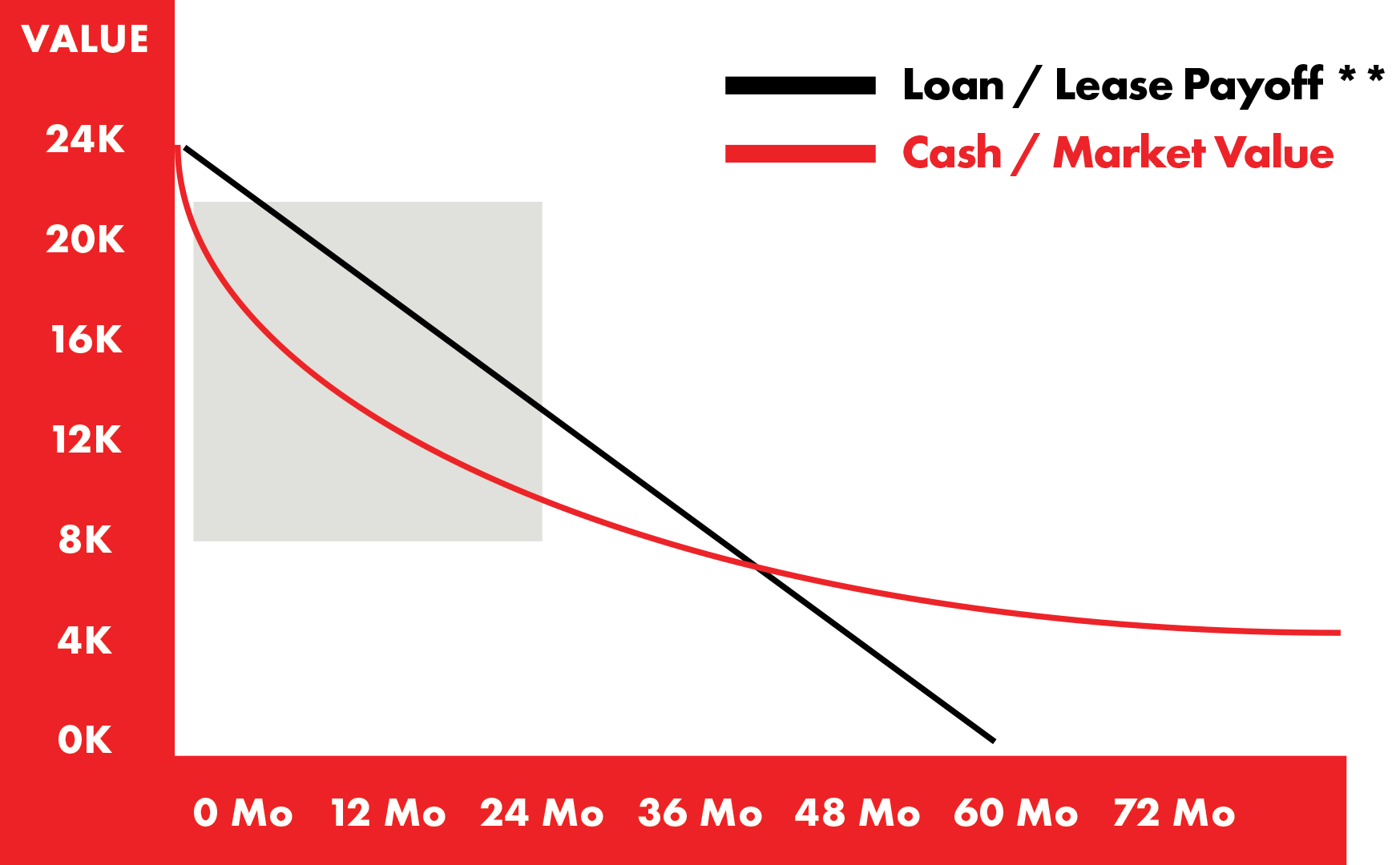

WHAT IS GAP? Guaranteed Asset Protection coverage pays the difference between the scheduled principal balance on your auto loan and the actual cash value (ACV) of your vehicle.

WHAT DOES GAP COVER? GAP pays the difference between the outstanding scheduled principal balance and the vehicle’s actual cash value, determined by your primary auto insurance carrier, on your auto loan or lease in the event of total loss or theft. GAP covers up to $1,000 of the borrower’s deductible if there is a ”GAP“ after the primary insurance settlement is paid.

Example:*

| Insurance Settlement | Loan Settlement | ||

| Actual Cash Value | 16,000 | 20,000 | Outstanding Loan Balance |

| Insurance Deductible | -1,000 | -15,000 | Insurance Settlement |

| Insurance Settlement | 15,000 | 5,000 | GAP |

GAP Statistics

- According to Automotive News the average new car will lose 60% of its value over 3 years of normal driving.

- The Insurance Information Institute estimates that one vehicle is stolen in the United States every 24 seconds.

- CCC Information Services, a firm that supplies the automotive claims and collision repair industries with collision statistics, tells us that 18% of vehicles involved in a collision will result in a total loss.

- Insurance companies report that on an annual basis they write off 500,000 insured vehicles due to total loss, fire or theft.

However, you may be surprised to learn that in the event of a total loss, the settlement amount received from your insurance company is the actual cash or market value of your vehicle. In many cases, this amount is less than what you owe the lender or lease company and you are responsible for the difference.

IWS offers members the following Guaranteed Asset Protection(GAP) plans:***

STANDARD COVERAGE

Standard Coverage pays the difference between the actual cash value (ACV), established by the primary casualty insurance carrier, and the principal amount or lease deficiency.

GAP also covers up to $1,000 of the borrower’s deductible. The deductible benefit is not available for lenders domiciled in certain states.

PREMIUM COVERAGES

How Do I Get GAP Protection? GAP is available for a nominal cost and may be purchased anytime during the loan term. However, it is generally not recommended after 18 months into the loan. Ask your loan representative for details.

* This could be the out of pocket amount you would pay if your vehicle is stolen or damaged beyond repair. The deductible benefit is covered as part of the deficiency balance and is not paid directly to the borrower.

**Limitation of Protection: The information reflected in the graph is provided for illustrative purposes only. The actual payoff relative to value of a particular vehicle may vary.

*** Availability of GAP plans and deductibles may vary by state.

IMPORTANT NOTICE

*This brochure is not a contract. Due to size limitations, only a general summary of the Guaranteed Asset Protection Plan is provided. For detailed information, refer to the Guaranteed Asset Protection Program.

5901 Broken Sound Parkway, NW

Suite 400

Boca Raton, Florida 33487

Toll Free: 800.333.3028

Claims Service Center (Toll Free): 866.888.2085

Tel: 561.981.7000 • Fax: 561.981.7048

Website: iwsgroup.com

Florida License #13636 PREM062021